Introduction to conventional covered call trading strategy

(Click here to understand call options)

Structure description

Covered call (aka buy-write) is an income enhancement option trading strategy that is structured by purchasing (long) a stock and at the same time, selling (short) a call option on the same underlying stock. Usually the notional amount of shares of both positions offsets each other (when call multiplier is 100, it corresponds to 100 shares).

Expected payoffs

Comparing to long-stock-only strategy, the covered call investor earns option premium at the initiation of the trade by selling the call, and is obliged to sell the underlying stocks to the call option owner (buyer) at the strike price if the stock price finishes above the strike price on or before the expiration day.

To simplify discussion, we use European style call option, which can only be exercised at expiry day (American option is similar to European style in the case of Covered Call).

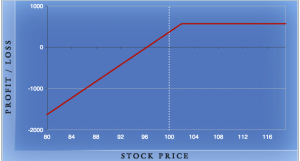

At expiration day:

- If the stock price finishes lower than or equal to the strike, the call expires worthlessly; the total return to the covered call investor is the sum of stock price change plus call premium

- If the stock price finishes above strike, then the option finishes in the money, the covered call investor is obliged to sell the underlying stock at strike to the option owner; the total return to the covered call investor is the sum of stock price appreciation up to the strike and the call premium (upward profit is capped at strike)

An illustration diagram is as follows.

Return Characteristics

Covered call is generally viewed as a low risk option trading strategy.

Most people trade covered call when they have a neutral market view for the underlying stock during the trade cycle and expects to earn enhanced income by selling near month slightly out of money calls continuously (roll to next option cycle at expiries), until the market view for the stock changed.

As depicted in the above diagram, covered call outperforms stock up to a certain stock level (strike + call premium), and then the upside return is capped when stock level is above strike price. In other words, the covered call strategy provides extra income and cushion for a flat or downward stock movement by trading off upward participation.

Construction of the trade

A successful covered call trade shall provide the right balance among many factors:

- Choose an underlying stock with little down side risk

- Choose a right combination of expiry and strike level to maximize return

- The strike chosen shall also minimizes the probability of being assigned (finish in the money)

A thorough trade analysis is very important before carrying a trade.

Underlying candidate

Not all stocks are good candidates for covered calls, and not all market conditions are good for trading covered calls. Investor shall fully understand underlying stock characteristics, such as past price performance, trends, trading volume, volatility, etc. Investor shall also be well aware of upcoming corporate events, such as earning releases, restructuring, lawsuits and M&A deals that are underway, etc.

Call expiry date

For an ideal market condition (flat), covered call strategy intends to make money through a slow process of time-decay of the call option. The time decay accelerates when expiry approaches. Therefore choosing a near term (front month) expiry instead of a longer term (back month) expiry provides a better return.

Call strike

For a given stock price, the time value of the call options is not constant for all strike levels, and it usually peaks at a level that is slightly above current spot price. When an investor holds a neutral market view, a slightly out of money strike will provide the best return (premium / stock price).

Expected return and risk management

The investor shall also be aware of different payoffs under different market scenarios. Risk management is important in all trading strategies. The covered call investor shall devise a trading plan based on payoff scenarios in case the market turns against investor’s market view. For example, if the earning release beats expectation and provides a very optimistic outlook, the investor might want to close the short call position in order to gain more upside participation.

Trade Cycle

A covered call strategy is usually traded continuously month over month until the market condition violates the investor’s onset viewpoint.

Roll Out

At expiry day, if the call finishes worthlessly (ATM or OTM), the investor can simply sell another call for the next expiry cycle to roll the covered call forward.

If the call finishes in the money, the investor has two options:

- buy back the ITM call to close the position, and roll to next expiry call

- leave the option to be assigned and have underlying stocks called away; reconstruct the strategy at the open of next trading day

Position management and trade adjustment

Prior to expiry day, if the stock price moves out of the acceptable trading range, either too high or too low, the investor may choose to adjust the position based on new forecasts. Some examples are as follows:

- Close the trade entirely (both stock and call) if the stock turns very bearish

- Close the existing call position by buying back, and roll to another higher strike for the same expiry day (roll up) when the stock price moves higher and faster then anticipated

- Increase or decrease the trade size when market goes along or against initial trade plan